[Press Release]TidesquarexConsumer Insight predicts 2024 travel trends for outbound Korean travers

[PRESS RELEASE_202312]

Millennial and GenZ male travelers are on the rise and contactless travel is here to stay

Tidesquare x Consumer Insight

predicts 2024 travel trends for

outbound Korean travelers

-

Millennial and GenZ male

travelers to become a key demographic

-

Contactless travel continues to

be high priority as travelers prioritize safety and relaxation

-

Narrower travel destination

choices due to global unrest and high fuel prices

-

Increased role of exchange rate

and prices on destination selections

- Continued development of products and promotions to meet these trends

*Source

- Consumer Insight “Tracking Koreans’ Travel Behavior Changes 2017-2023”

(Presented at ‘Wit Seoul 2023’ on Nov. 2,

2023)

- Tidesquare (Tourvis, Kyte) 2023.01 – 2024.03

booking data

Travel technology company TIDESQUARE has

forecasted Korean outbound travel trends for 2024 based on 2023-2024 booking

trends and data from research firm Consumer Insight.

Based on data presented by Consumer Insight at ‘WiT Seoul 2023’ on Nov. 2, 2023 and internal booking trends,

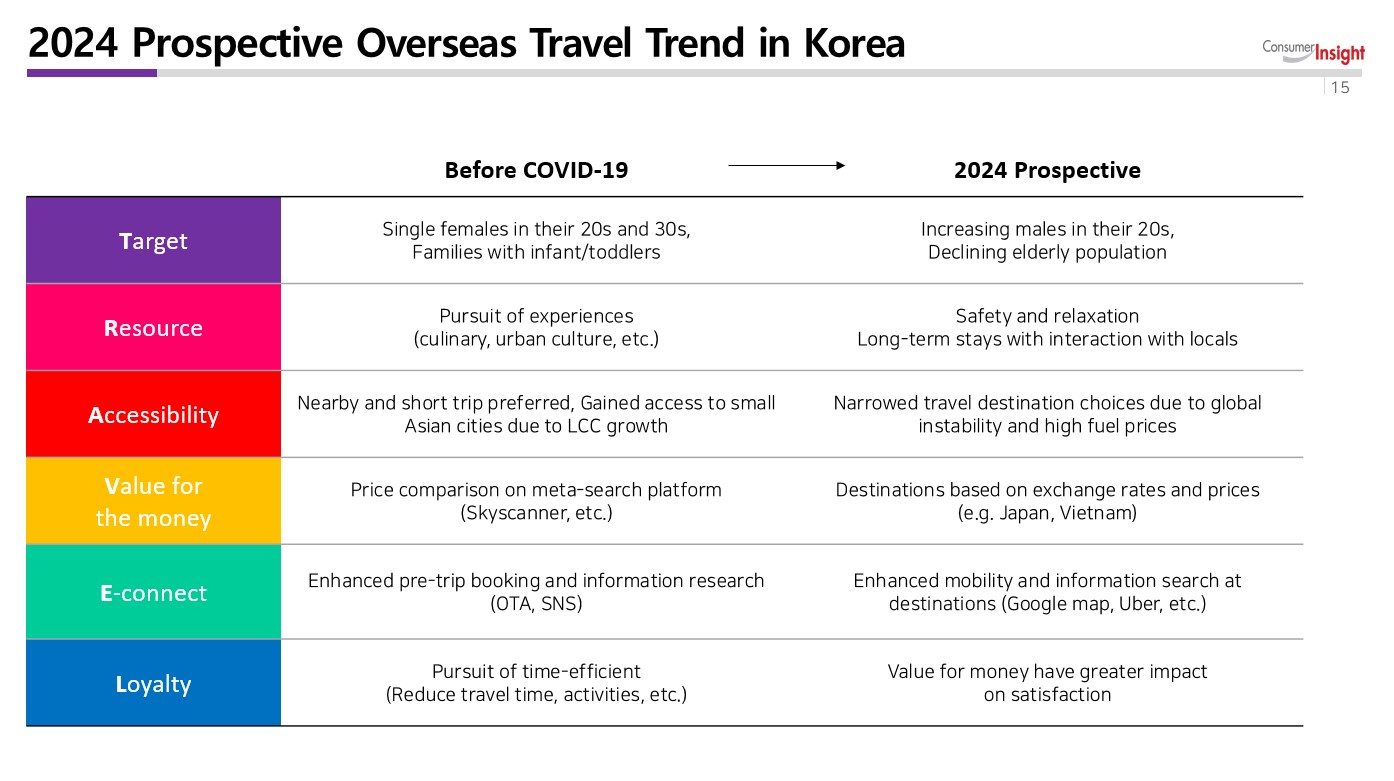

TIDESQUARE analyzed traveler behavior and purchase journeys to predict major changes from the pre-COVID 19 era, including the continuation of contactless travel, narrow scope of travel destinations due to global unrest and high oil prices as well as stronger mobility services.

Predicting a rise in small-town travel

destinations

According to Consumer Insights' analysis of T.R.A.V.E.L. - the six key factors that shape traveler behavior and attitudes - the most significant change in the “Target” audience in 2024 will be men in their 20s. There will also be some shifts in travel patterns as single women in their 20s and 30s and families with infants and toddlers,

who were key pre-COVID-19 travelers, become less common and the older population declines.

“Resource” predicts that the "contactless" travel trends that have been established during the pandemic will

continue for the foreseeable future, with people seeking safety and relaxation. Tidesquare data shows that while major cities with popular tours and experiences have consistently been the most popular destinations, since the

second half of 2023 bookings for small towns and lesser known destinations have increased. In Japan, small town hotel bookings accounted for more than 22% of all hotel bookings in the country, with winter hot spring

destinations also increasing, not only in the more popular hot spring areas such as Yufuin, Haneda, Jozankei and

Noboribetsu, but also lesser-known hot spring areas such as Arima, Gero and Kurokawa. In Vietnam, the

proportion of accommodation bookings in smaller cities other than Da Nang and Hanoi more than doubled

year-on-year, demonstrating a new direction in contactless travel.

Strong growth in short-haul destinations

with strong impact of exchange rates

In terms of “Accessibility”, international travel will continue to grow as COVID-19 becomes an endemic in most

destinations, but in 2024, global unrest and high fuel prices will narrow the choice of destinations. In 2023, the

most popular overseas air routes were Tokyo (13.77%), Osaka (11.89%), Fukuoka (10.64%), Da Nang (3.25%), and

Bangkok (2.88%), and the top five were all in East Asia, with the commonality being short-haul destinations of

around 5 hours. Booking trends for Q1 2024 are expected to be similar to those for Q1 2023, with short-haul

destinations around 5 hours continuing to be strong for the foreseeable future.

“Value for money” as a criteria in selecting destinations is going to increase in importance. While in the past,

travel plans were made by comparing ticket prices on metasearch platforms such as Skyscanner and Naver, next

year they are expected to be influenced by other factors such as exchange rates and local prices. In the case of

Japan, with its close proximity as well as fall of Japanese yen against Korean won (100 yen : 800 KRW in

November 2023), flights to Japan accounted for 30% of airline ticket bookings this year and into the first quarter

of next year.

Increased use of mobility services and

luxury goods

Along with changes in travel trends, changes in “E-connect” (information channels) are also expected. While

OTAs and SNS will remain influential in pre-trip bookings and information searches, the number of people looking for information in destination will increase, and mobility services such as Google Maps, Uber, and KakaoT, which

allow users to

check travel routes and book taxis, electric bicycles, and kickboards, will be

widely used.

“Loyalty” seems to be the at the core of the shift in consumer spending. As the

standard of satisfaction focuses

more on recreation and healing, the tendency to pursue “value-for-money” travel, which emphasizes efficient use of time is likely to increase rather than “value-for-money” travel focusing unconditionally on cost-saving.

As a result, demand for products that prioritize safety and

private packages such as VIP tours and luxury

hotels is expected to increase.

With the declaration of COVID-19 being an endemic in May 2023, Korean outbound travel sentiment rebounded

once again and 2024 will be a time to take a leap forward with travel trends that have changed before and after

COVID-19.

Min Yoon, CEO of TIDESQUARE stated “Travel trends change every year but the competitiveness of travel

platforms is the differentiated technology and specialized services they offer. We plan to continue to lead the

way utilizing the latest technology and provide trend-customized services in 2024 by collaborating with various

mobility services such as Kakao Mobility and

launching a new premium travel platform."

*TIDESQUARE (www.tidesquare.com)

TIDESQUARE is South Korea’s leading technology focused travel agency and operator of OTA brand “Tourvis” and #1 premium OTA brand “Privia Travel”. Established in 2009, TIDESQUARE is a top 3 BSP travel agent (Nov. 2022

BSP ranking) with a strong network of global and local partnerships with industry-leading platform operators

including Kakao Mobility,

SK Telecom and Naver. TIDESQUARE stands at the forefront of the South Korean

travel landscape leading NDC and direct airline connectivity as the first

Korean agency to obtain NDC certification.